I'm 90% sure that if you are a WA resident, Use Tax is triggered as soon as you bring the boat into WA. If you are a non-resident, then you have a grace period because it's presumed you are just visiting on a temporary basis.

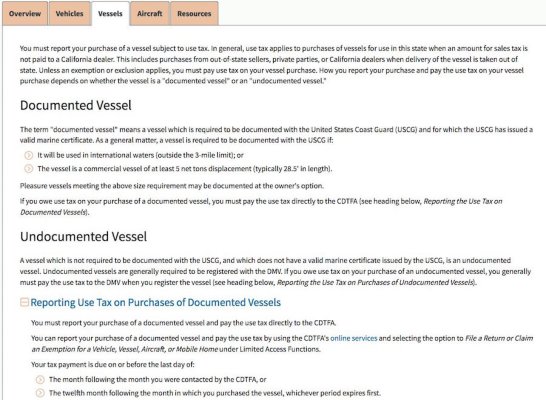

Also, it's worth clarifying the difference between Sales Tax and Use Tax. Sales tax is on a transaction that occurs in a state. If the transaction doesn't occur in the state, then they can't levy Sales Tax.

Use Tax, on the other hand, is a clever way of still collecting tax on out of state purchases where they were subject to someone else's Sales Tax. It varies by state, but if you bring a boat into the state and plan to keep it there, they will charge a Use Tax for that privilege. Most will credit you for Sales or Use taxes paid elsewhere, but check to be sure.

In the PO's case, since he doesn't plan to keep the boat in CA, the actual sale transaction should be conducted off shore where it is no subject to CA state sales tax. There are forms that you fill out and either keep or file (I don't recall which) to document it all. When you then re-enter CA, you are a visitor just like if you came in from OR or MX.

Then go down to Mexico as you plan, enjoy your self, then make your way back to WA where you plan to keep the boat. When you bring the boat into WA, and since you are a WA resident, Use Tax will trigger right away. You will need to pay, register in WA, and you will also become subject to their annual excised tax on the value of the boat.

Speaking of Mexico, singe the boat is in Mexico currently, it will have a TIP (temporary import permit). You will need to get that cancelled before you can apply for a new TIP in your name. So be sure to get the TIP from the previous owner. Cancelling and reissue can take time, so plan accordingly.

Thanks Again to all that helped with information.

Thanks Again to all that helped with information.