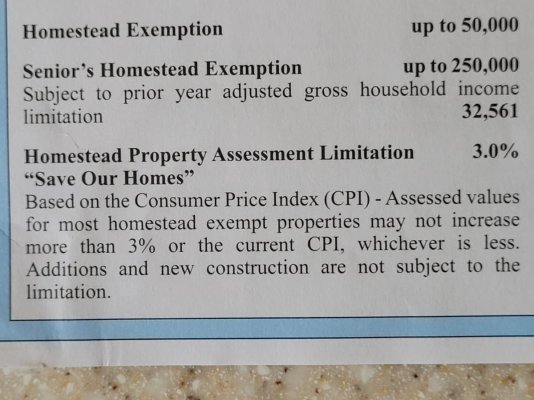

This is sort of how it works:

My property is limited to a 2% assessed value increase, not market value. A lot of homes were damaged or destroyed by hurricane Ian. Those homes are devalued by state law. Those damaged are reduced to their current value, until they're repaired. Those destroyed are reduced to the land value.

All the assessed values are added up. The county budget is then divided by all the assessed land value to create the millage. Multiple the millage to each property's assessed value and you get what your property tax is. It's more complicated than that and there are different line items, but that's basically how it works.

The budget was significantly bigger than the normal increase and the total assessed value of the county was reduced from all the losses, so I got about a 6% increase.

My condo marina was damaged and power was out for a year. So the assessed value of my slip dropped along with the taxes. No worries, it will be fully repaired before the next tax assessment.

Ted